Business Insurance in and around Lenexa

Researching coverage for your business? Look no further than State Farm agent Jeff Zigmant!

Insure your business, intentionally

State Farm Understands Small Businesses.

You may be feeling like there is so much to do with running your small business and that you have to handle it all by yourself. State Farm agent Jeff Zigmant, a fellow business owner, understands the responsibility on your shoulders and is here to help you personalize a policy that's right for your needs.

Researching coverage for your business? Look no further than State Farm agent Jeff Zigmant!

Insure your business, intentionally

Protect Your Future With State Farm

If you're looking for a business policy that can help cover business property, extra expense, and more, State Farm may be able to help, just like they've done for other small businesses since 1935.

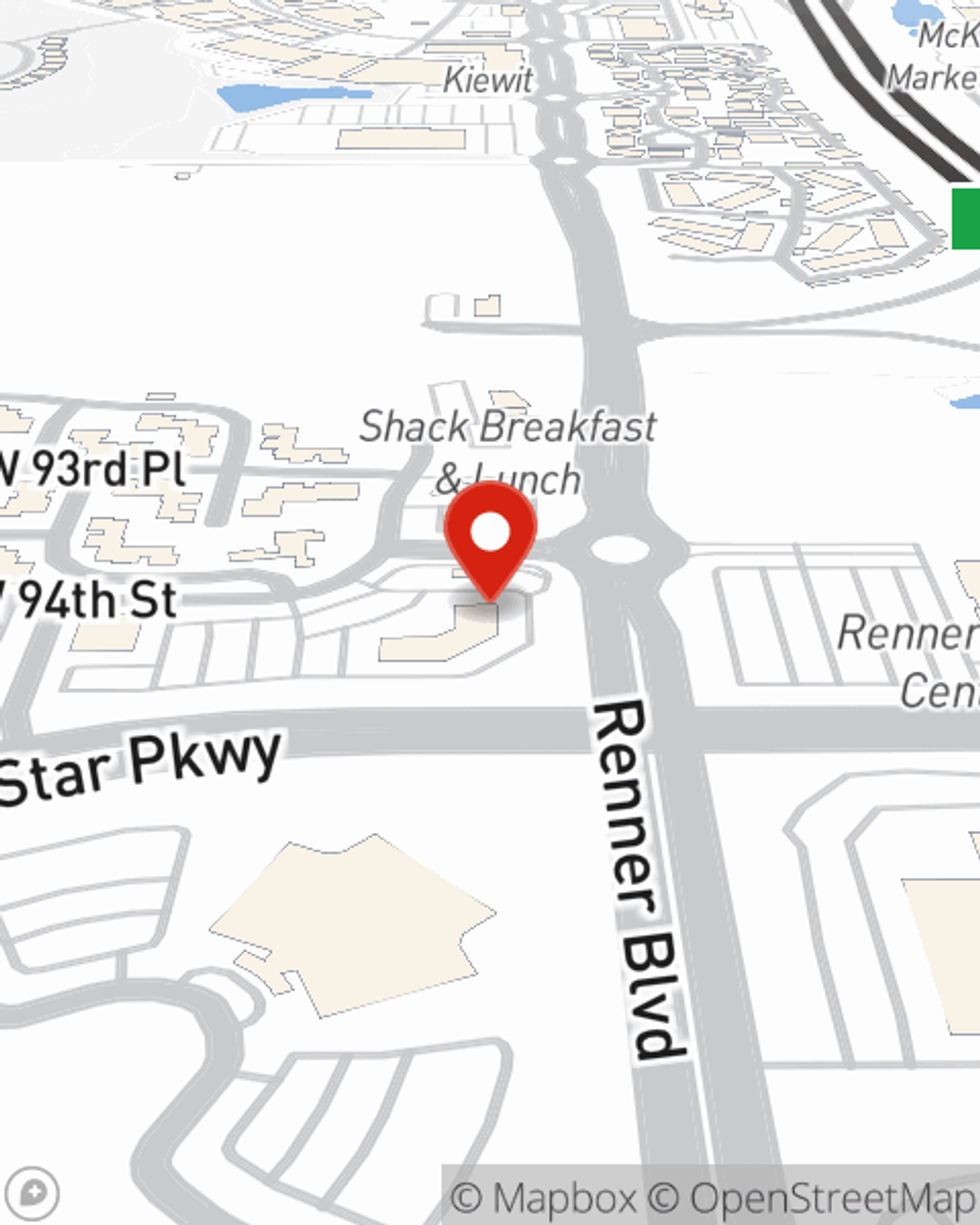

Contact State Farm agent Jeff Zigmant today to find out how a State Farm small business policy can safeguard your future here in Lenexa, KS.

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Jeff Zigmant

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.